‘…those earning N83,333/month would pay zero’

I took some time today to do a quick review of the Personal Income Tax sections of the 2024 Nigeria Tax Bill. This is the section that affects Nigerian workers the most as it determines how much PAYE tax is deducted from their salaries.

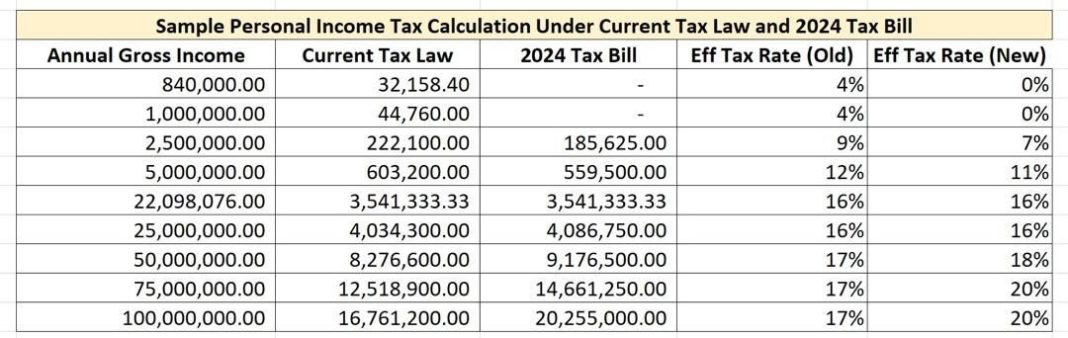

While it is true that those earning below N1,000,000 per annum (N83,333 per month) will pay zero tax under the new bill, the monthly savings for this category of workers is actually N44,760 yearly or N3,730 monthly. Their previous effective tax rate is 4%, but now reduced to 0%.

On the flip side, those earning above N22 million per annum (N1,833,000 per month) will be made to pay much higher taxes under the new tax regime. For instance, the effective tax rate begins to rise from an average of 16-17% to as high as 20% for this category of persons.

The key causative factor is the removal of the consolidated relief allowance under the new tax bill. This consolidated relief allows 21% of income or 20% of income plus N200k to be treated as tax-free under the current law but the new bill has removed the relief. A new relief – rent relief- was introduced but this is the lower of N200k or 20% of rent paid with evidence, which is a paltry sum when compared to the current consolidated relief allowance.

The proponents of the new bill appear to have been conspicuously silent on the removal of consolidated relief allowance for workers, by deliberately focusing only on those who will enjoy zero tax under the proposed law and not highlighting the impacts on other middle-class workers will have more taxes deducted from their salaries.

Frank Esanubi, FCA FCCA FCTI